how long does the irs have to get back taxes

This time restriction is most commonly known as the statute of limitations. The new tax changes are a welcome relief for people who have been impacted by.

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Federal law gives the IRS three years to audit taxpayers but there are exceptions that can extend the audit period to six years.

. If you did not file. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. Check For the Latest Updates and Resources Throughout The Tax Season.

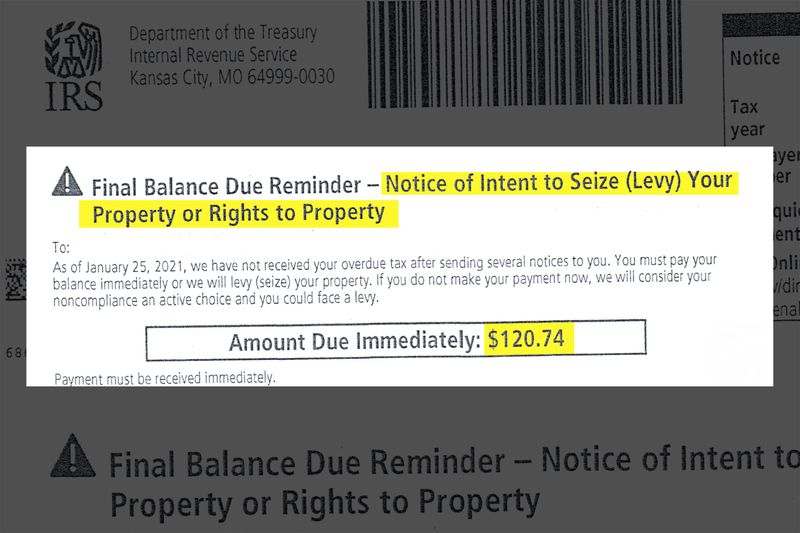

A Rated W BBB. Get Help Filing Years of Unfiled Taxes. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

Affordable Reliable Services. Learn How Long It Could Take Your 2021 Tax Refund. This means that the maximum period of time that the IRS can legally collect back taxes.

The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years. Top BBB Ethics Award Winner 2019. You cant calculate how far back the IRS can collect taxes without knowing when the countdown clock starts.

A Rated W BBB. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. How Does Taxpayer Relief Initiative Work.

However its possible your tax return may require additional review and take longer. An IRS Audit Can Sometimes Go Back Six Years. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts.

In 2013 the tax refund schedule was updated to state that the IRS issues most refunds in less than 21 days its possible your tax return may require additional review and take. Essentially the IRS is mandated to collect your unpaid taxes within. Your final option is to pay off your back taxes with a loan a personal loan a 401k loan a home equity.

Top BBB Ethics Award Winner 2019. Most of the time people can set up these payment plans on irsgov. This means that the IRS can attempt to collect your unpaid.

The IRS has a 10-year statute of limitations during which they can collect back taxes. The IRS calls special attention to people hit by recent national disasters. Ad Over 1500 5 Star Reviews.

As a general rule there is a ten year statute of limitations on IRS collections. At least a few states have said they plan to tax the forgiveness including Indiana and Mississippi and its unclear whether some others will change their tax rules to exclude. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit.

Is there a time limit to pay back taxes. Technically except in cases of fraud or a back tax return the IRS has three years from the date you filed your return or April 15 whichever is later to. The IRS 10 year window to collect.

Ad See How Long It Could Take Your 2021 Tax Refund. Ad Over 1500 5 Star Reviews. If Your Refund Isnt.

This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were. Get Help Filing Years of Unfiled Taxes. The collection statute expiration ends the.

Take Advantage of Fresh Start Options. As a general rule there is a ten year statute of limitations on IRS collections. First the legal answer is in the tax law.

They typically have 180 days after they leave the combat zone to file returns and pay any taxes due. The Taxpayer Relieve Initiative works by extending the time that. Pay Back Taxes With A Loan Credit Card Or Another Form Of Financing.

Free Confidential Consult. Ad See if you ACTUALLY Can Settle for Less. The IRS issues more than 9 out of 10 refunds in less than 21 days.

A Rating With Over 1500 5-Star Reviews. 11 hours agoPrices for gas rent and groceries have increased more than at any time in the last 40 years. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment.

A Rating With Over 1500 5-Star Reviews. The IRS 10 year statute of limitations starts on the day that your. A tax assessment determines how much you owe.

What To Do If Your Tax Refund Is Wrong

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Updated 2020 Do You Owe Back Taxes Here S What To Do

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

How Long Does The Irs Have To Collect Back Taxes Youtube

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Soi Tax Stats Irs Data Book Internal Revenue Service

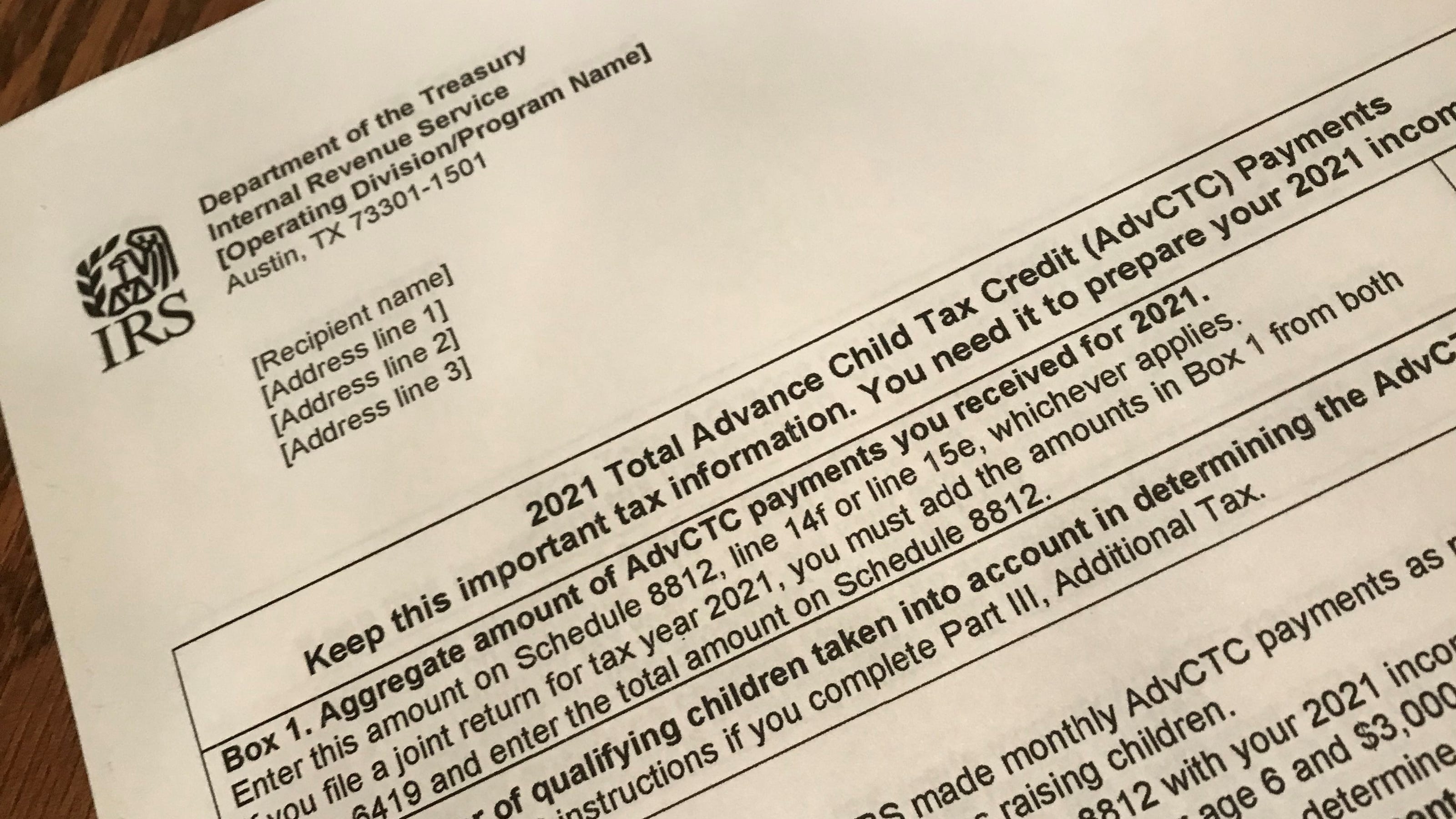

How Much Do You Get Back In Taxes For A Child In 2021 As Usa

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

How Long Does The Irs Have To Collect Back Taxes Youtube

Irs Audit What Why When In 2021 2022 Internal Revenue Code Simplified

Why 10 Million People Still Don T Have Their Tax Refund

Where S My Tax Refund When To Expect Your Money And How Much Extra The Irs Owes You Cnet

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

What Is The Best Way To Pay Back Taxes As Usa

Irs Plans To Hire 10 000 Workers To Clear Tax Return Backlog The New York Times

Where S My Refund Virginia Tax